[ad_1]

Major crypto derivatives exchange ByBit launched a spot trading pilot today and they have more products in the pipeline amid growing competition in the sector, Ben Zhou, the CEO of the company, told Cryptonews.com.

According to him, the platform saw more than USD 1trn worth of cryptoassets change hands in 2020. ByBit says it serves more than 2.5m customers in over 200 markets and supports more than a dozen languages.

“We expect the trend to continue to grow this year as we expand beyond perpetual contracts to quarterly futures, cloud mining, spot trading and options,” he said.

In the pilot version of spot trading, the exchange now supports BTC/USDT, ETH/USDT, XRP/USDT and EOS/USDT trading pairs while more to “follow shortly.”

The full version of spot trading will arrive before September, Zhou told Cryptonews.com.

Also, along with this, ByBit plans to introduce Wallet 2.0 for instant withdrawals, aiming to remove limits commonly associated with cold wallets, per the CEO.

Additionally, the company aims to launch options trading in the last quarter of 2021.

Other upcoming changes to the platform include upgrading the mobile app and desktop versions, supporting more local languages and fiat currencies.

They’ve also opened their ByFi Center for users to explore different mining contracts, noting that “cloud mining is no longer exclusive to the big leagues.”

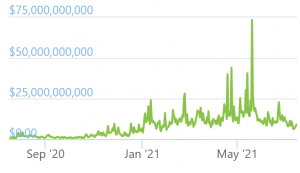

Trading volume on Bybit:

DAO and decentralization

Another major project for the company is BitDAO. In June, decentralized autonomous organization (DAO) BitDAO raised USD 230m, with ByBit pledging 2.5 basis points of their futures contracts trading volume to the BitDAO treasury.

“In all honesty, BitDAO is bigger than us,” said Zhou. “Dozens of institutions and DeFi projects have a stake. In a sense, BitDAO’s success will be entirely its own because its future will be decided by its community.”

According to the CEO, what we’re seeing now is new decentralized organizations competing on their ability to actualize the governance power by token owners – and the quality of the technology makes a difference.

Meanwhile, when it comes to decentralized exchanges, Bybit itself will “eventually” also follow the decentralized path, delivering their “centralized products in a more decentralized way,” said Zhou.

Regulatory triangle

With regulations tightening around the industry across the world, ByBit was not spared either. In June, it got a warning from Japan’s Financial Services Agency (FSA), stating that exchanges based outside Japan must not target Japanese residents with advertising campaigns without obtaining prior operating permission.

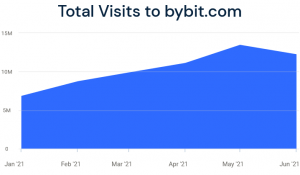

Per Similarweb data, in June, Japan was the second-largest market in terms of visits to Bybit.com (7%), however, the number of visits dropped by 21%, compared to May. Most visits were from South Korea (up by 26% in a month). Trading on this platform is not available to US investors.

In either case, when it comes to regulation, decentralization, privacy and anti-money laundering (AML) compliance is not “an impossible triangle,” but there are a lot of misconceptions, according to the CEO. Therefore, regulatory clarity will benefit all stakeholders.

“Overall, we expect public demands for more decentralization and democratization – and rules will eventually have to catch up with that,” the CEO argued, adding that “I do fancy though new technologies and ideas we haven’t seen today might be the answer, not incumbent rules.”

Competition field

Per Zhou, “2020 was the year the power of retail investors manifested in the democratization of finance.” The realization of the power that retail investors have as a collective led to a number of “dramatic episodes” in the equity markets, such as GameStop.

“In many ways these events, both in the crypto and traditional financial markets, were revolutionary and challenged institutional investors to rethink their roles and strategies. It reflects a shift in mentality and the will of the masses to become responsible for their own prosperity,” Zhou said.

It is “most probably” a challenge to established institutions, and it does put retail investors at risk, and yet there is no definitive answer or a single solution when it comes to the regulatory responses, or even the question if they address the real issues in the first place.

But “the trend is irreversible,” said Zhao, “that retail investors, many young and less experienced, will demand better access and more transparency in any market they choose to participate in. And that’s what exchanges should compete on.”

____

Learn more:

– Coinbase Says It Is Targeting More Users, Not Lower Fees

– BNB Rallies While Binance CEO Bows To Regulators Amid Another Setback

– NBA, MLB, E-sports, And Now Bündchen & Brady Join FTX’s Marketing Team

– Obsessed Amateur Crypto Traders Are ‘Disproportionately Liquidated’

[ad_2]

Source link